In a political twist that could redefine the future of electric vehicles in the U.S., former President Donald Trump has launched a sweeping rollback of federal electric vehicle (EV) support programs—threatening Tesla’s growth and igniting concerns among investors. Even more surprising? Elon Musk, CEO of Tesla and long-time vocal advocate for EV adoption, is reportedly closer than ever to Trump, talking to him “almost every day.” Now, Tesla’s dependence on favorable regulations and green subsidies may come back to haunt it.

Trump’s War on EV Incentives

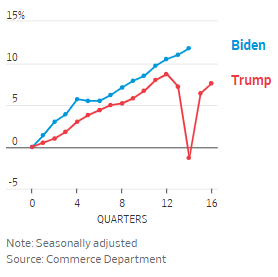

On January 20th, the Trump administration issued an executive order targeting numerous “green” government policies. Among the most impactful measures: eliminating subsidies for EVs, blocking states from enforcing their own EV mandates, halting funds for charging infrastructure, and reevaluating vehicle emission standards. While some of these changes—like scrapping EV tax credits—require congressional action, others could be implemented through administrative channels.

Sean Duffy, Trump’s head of transportation, has also signaled an intent to dismantle fuel economy and zero-emission vehicle (ZEV) standards, undermining regulatory credit programs that brought Tesla over $2.7 billion in revenue in 2024 alone.

Tesla’s Financial Engine at Risk

Tesla, unlike legacy automakers, doesn’t sell gas vehicles and therefore profits handsomely from selling EV credits. These credits have historically bolstered Tesla’s free cash flow—removing them could turn Tesla’s cash flow negative, especially as competition and market volatility ramp up. While Musk downplays the importance of subsidies—famously tweeting “take away the subsidies, it will only help Tesla”—data suggests otherwise.

“If this happened three or four years ago, it would’ve been a game-changer,” one analyst noted. “But it’s still a significant hit now.”

Musk’s Long Game: Autonomy and Robots

Amid tightening regulations and shrinking EV incentives, Tesla is doubling down on autonomous driving and robotics. The bullish case? Robotaxis, Optimus humanoid robots, and full self-driving software could unlock trillions in market cap—if regulatory approval materializes. Some investors, like Stephen Gengaro, remain confident, pricing Tesla shares at $474, mostly due to its long-term AI-driven ventures.

But not everyone’s convinced. Long-time investor Ross Gerber flatly states, “Autonomy doesn’t work… I can’t drive my Cybertruck for five minutes without disengaging autopilot.” His frustration is echoed by growing investigations into Tesla’s Autopilot and FSD marketing, with the Justice Department probing potential fraud.

Tesla’s Polarizing Image

Musk’s overt political alignment is also fracturing Tesla’s customer base. Once a darling of Democrats—who are statistically more inclined to buy EVs—Tesla is now facing a backlash. Its stock has plunged 32% in 2025, and vandalism at Tesla stores hints at deeper consumer resentment. Meanwhile, Republican interest has ticked upward, but the brand’s politicization has become a liability.

“Elon is probably the most hated person in the world right now,” Gerber says. “They’re taking it out on Tesla.”

The Bottom Line

While Tesla still dominates in scale, margins, and charging infrastructure, Trump’s EV cuts threaten to shake the very foundation the company was built on. With subsidies vanishing and political ties deepening, the company finds itself walking a tightrope between innovation and instability.

Will Tesla survive the MAGA era? Or is Elon Musk betting the company’s future on politics—and losing?