![]()

With an estimated fortune of $1.25 billion, 30-year-old Lucy Guo, a young Chinese-American entrepreneur, has surpassed pop star Taylor Swift to become the youngest self-made female billionaire in the world. Her journey—from a self-taught programming prodigy to the youngest self-made billionaire—is a story of talent and boldness.

From a Self-Taught Girl to a Tech Prodigy…

Born in 1994 in Fremont, California, to a family of Chinese immigrants, Lucy Guo was raised by parents who were both electrical engineers. Despite their advice to steer clear of the tech industry due to the challenges faced by women, Guo quickly proved her innate talent. By second grade, she had begun teaching herself to code and earned money through PayPal by developing bots for the game Neopets, selling in-game items for profit. In high school, she won awards in several computer science competitions, laying the groundwork for her future career.

In 2014, Guo enrolled at Carnegie Mellon University, majoring in computer science, but she soon dropped out after being awarded the $100,000 Thiel Fellowship—a grant from billionaire Peter Thiel for young people who leave college to pursue entrepreneurship. This bold move brought her to Silicon Valley, where she began her path to conquering the tech industry.

In Silicon Valley, Guo gained valuable experience through internships at Facebook and Snapchat, where she became Snapchat’s first female designer, contributing to the development of the Snap Maps feature. She later joined Quora as a product designer, where she met Alexandr Wang, who would go on to become her co-founder at Scale AI. These formative years helped Guo sharpen her product design skills and sparked her awareness of artificial intelligence (AI) as a transformative force for the future.

…To Becoming the World’s Youngest Self-Made Woman Billionaire

In 2016, at the age of 21, Guo co-founded Scale AI with Alexandr Wang. The San Francisco–based company specializes in providing data-labeling services to train AI models, serving major clients like OpenAI, Toyota, and the U.S. government. Scale AI quickly rose to prominence as a tech unicorn, reaching a valuation of $7.3 billion (approximately 185 trillion VND) by 2021.

At Scale AI, Guo took charge of operations and product design, playing a key role in the company’s success and earning a spot on the Forbes Under 30 list in 2018.

However, that same year, Guo decided to leave the company due to “differences of opinion” with Wang. Despite her departure, she chose to retain nearly 5% of Scale AI’s shares instead of selling them— a decision that turned out to be incredibly wise.

According to Forbes (U.S.), as of April 2025, Scale AI’s valuation had soared to $25 billion (approximately 636 trillion VND), marking an 80% increase compared to May of the previous year. This surge also boosted Guo’s net worth, which now stands at $1.2 billion (around 30 trillion VND), comprising the majority of her fortune. With the inclusion of the value of Passis, her second startup, Forbes estimates Guo’s total net worth at $1.25 billion (roughly 31 trillion VND).

With this figure, Lucy Guo has officially become the world’s youngest self-made female billionaire, surpassing even pop icon Taylor Swift (age 35). Globally, there are currently only six self-made female billionaires under the age of 40, and Guo is the youngest among them. The others include Swift (35), Daniela Amodei (37), Melanie Perkins (37), Rihanna (37), and Lu Yiwen (37).

It’s important to note that, in the current context, Scale AI is finalizing an offering that will allow early employees and investors to sell their shares—meaning Lucy Guo’s total fortune could increase even further if she decides to transfer her stake to other investors. However, Forbes reports that Guo has not commented on whether she intends to sell her shares.

“Honestly, I don’t think much about wealth. It’s kind of absurd. It’s all just paper value,” Guo shared in an interview with Forbes.

Her decision to hold onto her shares reflects Guo’s long-term vision and confidence in Scale AI’s potential, even though she is no longer directly involved in the company’s management. This is not only a financial victory, but also a testament to her ability to make strategic decisions during challenging moments.

Facing the Crisis

After leaving Scale AI, Guo continued to cement her place in the industry with two major ventures. In 2019, she co-founded Backend Capital, a venture capital fund focused on early-stage startups. The fund has invested in companies like Ramp, a fintech startup that has reached a multi-billion-dollar valuation. Backend Capital helped Guo solidify her influence in the startup ecosystem, especially among young founders.

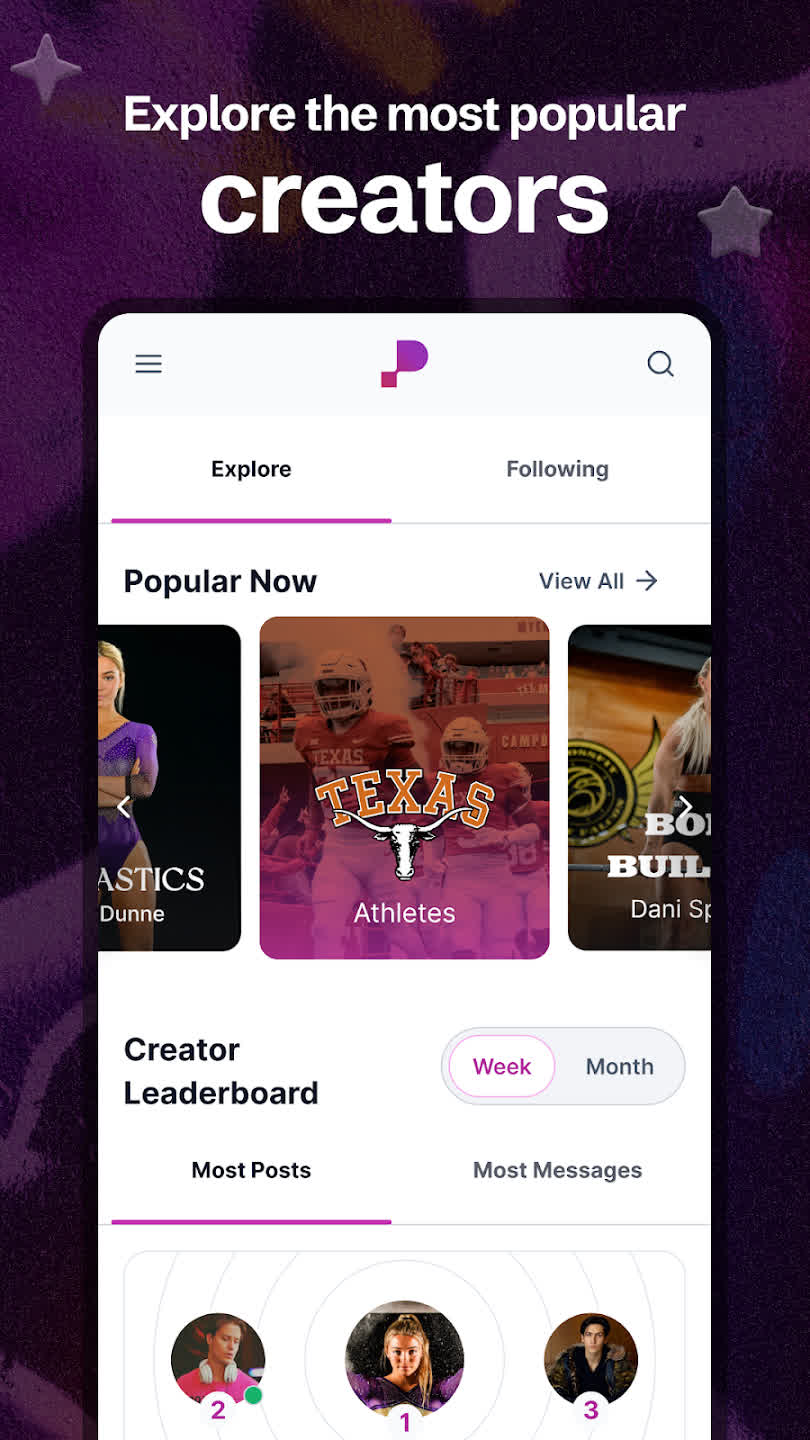

In 2022, Guo launched Passes, a platform that enables content creators to earn income through subscriptions, directly competing with services like Patreon and OnlyFans. Passes incorporates artificial intelligence (AI) to generate digital avatars, allowing celebrities to interact with fans through livestreams, messages, or video calls. The platform has attracted high-profile users such as athlete Olivia Dunne and DJ Kygo, and raised $50 million in funding from investors including Bond Capital, reaching a $150 million valuation by 2024. Passes has been a key contributor to Guo’s $1.25 billion fortune, further strengthening her position in the tech industry.

Facing the Crisis

After leaving Scale AI, Guo continued to cement her place in the industry with two major ventures. In 2019, she co-founded Backend Capital, a venture capital fund focused on early-stage startups. The fund has invested in companies like Ramp, a fintech startup that has reached a multi-billion-dollar valuation. Backend Capital helped Guo solidify her influence in the startup ecosystem, especially among young founders.

In 2022, Guo launched Passes, a platform that enables content creators to earn income through subscriptions, directly competing with services like Patreon and OnlyFans. Passes incorporates artificial intelligence (AI) to generate digital avatars, allowing celebrities to interact with fans through livestreams, messages, or video calls. The platform has attracted high-profile users such as athlete Olivia Dunne and DJ Kygo, and raised $50 million in funding from investors including Bond Capital, reaching a $150 million valuation by 2024. Passes has been a key contributor to Guo’s $1.25 billion fortune, further strengthening her position in the tech industry.

However, Guo and Passes have recently faced a significant challenge.

Her second startup, Passes, has come under scrutiny following allegations that the platform enabled the creation, possession, purchase, sale, and distribution of content related to child pornography. Both Guo and the company have categorically denied these accusations.

Despite this serious obstacle, Guo remains a source of inspiration in the tech industry, holding firm to her vision of innovation and her unyielding spirit to keep moving forward. Notably, the life philosophies she advocates continue to guide her journey, underscoring her determination to confront adversity and persist in her career.

Guo is a strong advocate of the FIRE movement (Financial Independence, Retire Early), having learned to manage her finances through Reddit forums such as Lean FIRE and Fat FIRE. Despite her impressive wealth, she leads a relatively simple life—preferring to get around on an electric scooter and relying on Uber Eats instead of cooking. Guo is an active member of Barry’s Bootcamp and proudly shares that she has completed 3,000 workout sessions. She often promotes her personal motto: “Discipline > Dream.”

She owns a $6.7 million apartment in Miami’s One Thousand Museum and a $4.2 million home in Los Angeles, though she rarely flaunts these properties. One of her few indulgences is a $500,000 Audemars Piguet Tourbillon watch, which she sees more as a piece of art than just an accessory.